Will the people of Kerala be able to reap the rewards of Trivandrum Port?

Author: John Elias

A mind boggling revenue to the tune of IN₹ 50 lakhs (~US$ 59,000) in a single day! This is just a glimpse of the possibilities generated by the newly opened Trivandrum Port. This accounts for just part of the revenue, the transshipment revenue is not included here. Although the money is credited to the account of port operator Adani Ports, Trivandrum Port is crying out for the urgent oversight of the Union Finance Ministry, since foreign exchange is involved.

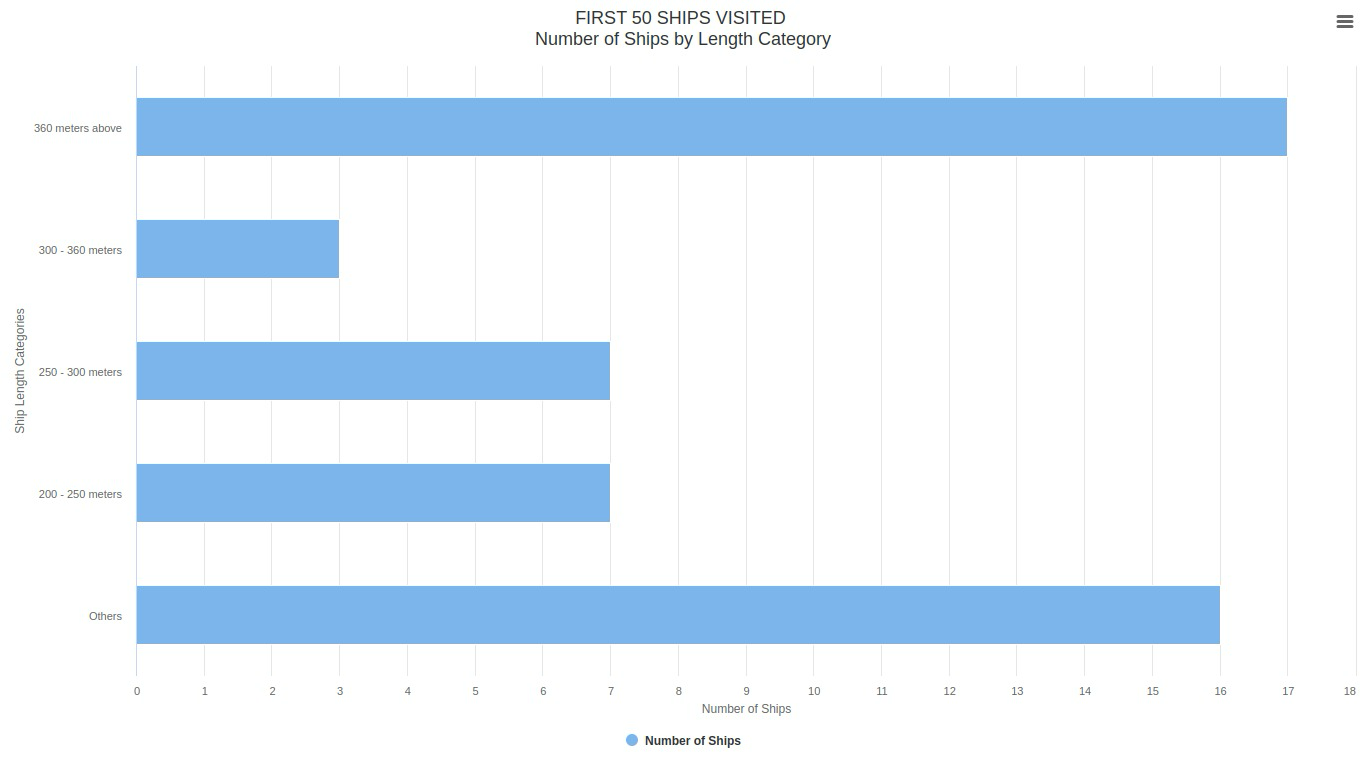

For now, we examine the matter of vessel handling. The daily charge of docking a 30,000 gross tonnage ship at Colombo is US$21,000. Adani Group has made the shipping industry sit up and take notice by charging only US$10,000 for the same service at Trivandrum Port. By lowering the rates, the Adani Group has shown that they can astonish the market! Going by these numbers, it would cost US$78,850 for MSC Claude Girardet to dock at Trivandrum Port for a day. Convert this into Indian currency and you get a mouthwatering IN₹ 65 lakhs. If other Indian ports also follow the same fee metric for port charges, this revenue by Trivandrum Port would easily be a single day record in India! Money flows in not only through vessel handling. We should look beyond the realms of profits. The 50 or so ships that have visited Trivandrum Port since the trial run began on July 11 is a testament in itself. Like MSC Claude Girardet, this includes 17 other ships of length in excess of 360m, some of which have not previously visited Indian shores.

A gentle reminder that Trivandrum Port is still not officially commissioned and what we are witnessing is just a trial run! As this article is being written, the total announced ships scheduled to arrive has reached 60. And just like Claude Girardet, many of these motherships are visiting Indian shores for the first time. This is Trivandrum Port's unique advantage, which the Adani Group, who undertook the project and brought to fruition, highlights. “The world class, future ready port is the only transshipment hub in the Indian subcontinent, closest to the international shipping routes, and is centrally located on the Indian coastline.” Adani Group does not view Trivandrum Port as just another port in India. The Indian subcontinent comprises 7 countries including the land locked countries of Afghanistan, Nepal and Bhutan. This also includes SriLanka with a coastline of 1,340km, Bangladesh with 1320 km and Pakistan with 1,046km. These countries are home to some historical ports which are centuries old (Chittagong 1887, Mumbai 1873, Karachi 1854 etc). Among these established giants is a young 4 month old port with a dare to dream.

We need to look at the bigger picture when examining the possibilities of Trivandrum Port. It is a known fact that 80% of the world’s trade is through shipping. This figure is expected to continue rising. The UN Trade and Development (UNCTAD) projects that global maritime trade will grow by 2% in 2024 and an average of 2.4% annually through 2029. A year before that, in 2028, Trivandrum port would have started its full-scale operations. Hence we will be able to attract a significant portion of the world’s trade. Global investments are also being channelled to capitalise on these advantages of world trade by placing orders for shipbuilding, alternative fuels and innovative technologies.

Let's focus exclusively on the case of container ships. In 2023, a record breaking 2.34 million twenty foot equivalent units (TEUs) of new container ships were ordered, with deliveries expected to continue into 2024. This surge in orders is largely driven by the exceptionally high profits made by shipowners in 2021-22, following a long standing tradition in the shipping industry (source: Meta). This includes revenue growth from all types of ships, such as container, bulk, tanker, and cruise ships. UNCTAD estimates that the operation of merchant ships contributes about US$ 380 billion in freight rates within the global economy. This increase in the number of large ships and the associated revenue they bring to the table should guide our thoughts and dreams. We should study the rise in demand for the other ships just as much as we study the growth of container ships. Stakeholders should try to create a shipping ecosystem alongside the largest container port. Bunkering, ship maintenance and cruise are essential components in this. The global forecast is also one which supports this gradual growth. Demand for most segments of seaborne trade is projected to increase between 2022 and 2050, with gas tanker transport and container shipping expected to grow the most. A well-defined 25-year vision, combined with focused execution, will enable us to make significant progress. The first step towards that is understanding our strengths and weaknesses. A port is just the starting point of a major ecosystem. But it will fail to yield the desired results if not properly executed. As a container port, we need to envision a broader picture based on future potential. The share of containerised shipments in seaborne trade reached 13.5% in 2021 and is estimated to amount to 13.9% by the year 2035. This means that the current cargo will not decrease for the next ten years and in-fact there will be a slight growth.

It is important to understand Adani Group’s views regarding this. “The full operations of the full length berth is also on the track. So, which means Vizhinjam is better than the plan in terms of realisation of the opportunity, and also we have already kicked off the second phase or the final phase where we are going to spend 20,000 crores as we announced on the next expansion of the Vizhinjam. So, which means for us, the first phase is done and now we are switching our gear to the final phase, which is the full development of Vizhinjam” ( Ashwani Gupta, CEO, Adani Ports and SEZ Ltd during Q2 FY25 presentation). It might be keeping in mind the short operational duration of 40-45 years that Adani Group is already thinking about the final phase of the project. It is up to the port owner, Kerala Government to decide whether to put a full stop at the current plan or keep adding phases to take full advantage of Trivandrum Port. The global model shown below should help them in making a calculated decision.

Since 2010, Shanghai, China, has been the world’s largest container port. Here are some key statistics that highlight its scale.

- Handles ~50 million containers (TEU) annually.

- More than 30,000 container ships per year

- 187 weekly mainline service connections

Given the high benchmarks already set, are we doing justice by putting a full stop and discussing the final phase of the project—especially when no other port in India can compete with the Shanghai port? Let us make our dreams as wide, deep and vast as our seas.

It is important to keep our feet grounded when dreaming big. As the projected completion date of all phases of Trivandrum Port has been shortened from 2045 to 2028, the target of 6.2 MTEU has also been set. Those familiar with the success of Adani Group will know that this is a more than achievable target. In October 2024 alone, Adani Group had collectively handled 37.9 MTEU of cargo. This includes a growth of 19% in container handling. Such an accomplished group will not find it hard to achieve the target of 6.2 MTEU in Trivandrum Port. But there are concerns if this will translate to growth and development in the catchment area of the port. There have been no strides to generate gateway cargo. It won’t be long before we see the port struggling due to a lack of connectivity. Only the generation of gateway cargo can lead to a growth in the regional employment opportunities. Let’s examine this with the help of an example. A feeder vessel that arrived in the past days unloaded 1086 TUE containers. These will soon be loaded and shipped via a mothership. Only the truck drivers who take these containers to the ship to shore cranes benefit from this process. Even if the port is opened for gateway cargo, how many of the above mentioned containers will be used for stuffing or export? The port vicinity currently is not equipped to fill even a single container with export goods. Not even a single warehouse, whether big or small, has started operations anywhere near the port. It is important to make changes on a war footing so that the port is not limited to being just a transshipment port. Only then, will at least a small portion of the huge revenue generated by the port trickle down to the common man. The Kerala Government must take initiative to tackle this issue, but from past experience we are aware of the snail’s pace of their initiatives.

Vizhinjam International Seaport Ltd (VISL) has been functioning for some time now with the concept of port-led industrialisation. They have advertised for the role of a consultant for this purpose. The job description includes studying and giving ideas regarding the investment in and around the port vicinity. The future of the port-led industrialization study itself is in trouble, as the advertisement had to be republished due to poor response.

Adani group is striving to be the world’s biggest port operator. They are currently operating 15 ports or terminals in the east and west coasts of India. In addition to this, they have also started operations in Colombo, Haifa (Israel) and Dar Ul Salam (Tanzania). As they strive towards their goals, will the common folk of Kerala go hand in hand in reaping the rewards or will they be fated to just be mere observers and admirers of giant shipping vessels like MSC Deila that prosper off their waters.